Payment Methods in Gambling – Why Choice Matters for UK Players

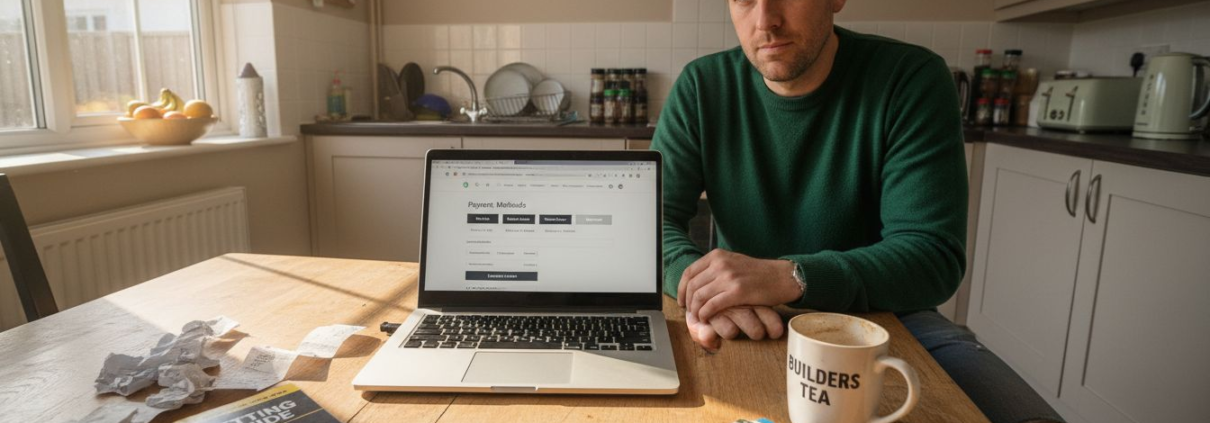

Choosing the right way to move your money in and out of UK online casinos can often feel confusing. With so many options on offer, the balance between convenience, security, and responsible play becomes even more important. Whether you prefer classic debit cards, fast electronic wallets, or more modern ways to pay, understanding regulated gambling payment methods helps you play smarter while keeping your funds and bonuses fully protected.

Table of Contents

- What Are Gambling Payment Methods?

- Popular Payment Types Explained

- Legal Rules Shaping UK Transactions

- Payment Methods and Safer Gambling

- Risks, Mistakes, and Security Concerns

Key Takeaways

| Point | Details |

|---|---|

| Recognition of Payment Methods | Understanding the variety of payment methods available enhances players’ ability to manage their finances effectively. Choose methods that align with personal security and privacy preferences. |

| Regulatory Compliance | Always verify gambling sites for compliance with the UK Gambling Commission’s regulations to ensure the protection of your funds during transactions. |

| Responsible Gambling Practices | Utilise built-in tools like deposit limits and real-time spending tracking to maintain financial control and prevent impulsive gambling. |

| Awareness of Risks | Stay vigilant about the inherent risks associated with online gambling transactions, including identity theft and uncontrolled spending habits, and implement protective measures. |

What Are Gambling Payment Methods?

Gambling payment methods represent the financial channels through which players deposit funds and withdraw winnings in online casinos. These methods are the digital bridges connecting players’ bank accounts or electronic wallets to gambling platforms, enabling seamless financial transactions within the United Kingdom’s regulated gambling ecosystem.

Typically, gambling payment methods encompass several key categories: traditional banking options, electronic wallets, credit and debit cards, and emerging digital payment solutions. Each method carries distinct advantages and considerations for UK players. Credit cards like Visa and Mastercard offer immediate transactions, while bank transfers provide secure but slower fund movements. Electronic wallets such as PayPal and Skrill have gained significant popularity due to their speed and additional security layers.

The UK Gambling Commission mandates strict regulations around these payment channels to protect players. Operators must now implement transparent deposit limit systems and provide clear information about fund protections. This means players can choose payment methods knowing they are backed by robust regulatory oversight. New regulatory changes ensure that gambling platforms disclose exactly how player funds are safeguarded, giving consumers increased confidence in their financial interactions.

Pro tip: Always verify a gambling site’s payment method security protocols and choose platforms that offer multiple withdrawal options to maximise your financial flexibility.

Popular Payment Types Explained

UK gamblers have access to a diverse range of payment methods, each offering unique advantages for online casino transactions. Payment options in the UK gambling market have evolved significantly, providing players with multiple ways to manage their gambling funds securely and efficiently.

Credit and debit cards remain the most traditional payment method, with Visa and Mastercard dominating the market. These options provide instant deposits and are widely accepted across gambling platforms. Electronic wallets like PayPal, Skrill, and Neteller have gained substantial popularity, offering faster withdrawals and an additional layer of financial privacy. These e-wallets allow players to keep their banking details separate from gambling sites, adding an extra security dimension.

Moreover, emerging payment technologies are reshaping the gambling finance landscape. Prepaid cards provide controlled spending options for players wanting to limit their gambling expenditure. Cryptocurrency methods like Bitcoin are gradually gaining traction, appealing to tech-savvy gamblers seeking anonymity and rapid transactions. Mobile payment solutions are also becoming increasingly prevalent, allowing players to fund their accounts directly through smartphone platforms. The Gambling Survey for Great Britain highlights the growing diversity of payment preferences among UK players, reflecting the dynamic nature of online gambling finance.

Pro tip: Always choose a payment method that offers both transaction speed and robust security features, and consider maintaining a separate bank account for gambling activities to better manage your financial boundaries.

Here’s a concise comparison of popular gambling payment methods used in the UK:

| Payment Method | Average Deposit Speed | Privacy Level | Suited For |

|---|---|---|---|

| Debit Card (Visa) | Instant | Moderate | Everyday casino players |

| E-wallet (PayPal) | Minutes | High | Privacy-focused users |

| Bank Transfer | Few hours to days | High | Large transactions, safety |

| Prepaid Card | Instant | Very High | Budget-conscious gamblers |

| Cryptocurrency | Variable | Maximum | Tech-savvy, anonymity-seekers |

Legal Rules Shaping UK Transactions

The United Kingdom maintains a robust legal framework governing gambling transactions, designed to protect players and ensure financial integrity. Gambling laws establish comprehensive regulatory standards that dictate how financial transactions can be processed within online gambling platforms, creating a secure environment for players.

The Gambling Act 2005 and subsequent amendments form the cornerstone of these regulations, providing detailed guidelines for operators. These laws mandate strict licensing requirements, ensuring that gambling platforms meet rigorous financial compliance standards. Operators must implement comprehensive anti-money laundering protocols, verify player identities, and maintain transparent financial reporting. This regulatory approach prevents fraudulent activities and protects consumers from potential financial risks associated with online gambling.

Moreover, UK gambling codes of practice require operators to implement advanced financial controls that go beyond basic legal requirements. Gambling transaction codes specify precise mechanisms for managing player funds, including mandatory safeguarding of deposits and clear guidelines for withdrawals. These regulations ensure that gambling platforms cannot misuse player funds, providing an additional layer of financial protection. The focus remains on creating a fair, transparent system that prioritises player safety and financial accountability.

Pro tip: Always verify a gambling site’s gambling commission license number and check its regulatory compliance before making any financial transactions.

Payment Methods and Safer Gambling

Payment methods play a critical role in promoting responsible gambling practices across the United Kingdom. Safer gambling tools integrated into payment systems provide players with proactive mechanisms to manage their gambling expenditure and protect themselves from potential financial harm.

Modern online gambling platforms now incorporate sophisticated financial controls directly into their payment interfaces. These features include customisable deposit limits, cooling-off periods, and real-time spending tracking, which enable players to set and maintain personal financial boundaries. By embedding these safeguards within payment methods, operators create a more transparent environment where players can make informed decisions about their gambling activities. Some electronic wallets and banking interfaces now automatically flag unusual spending patterns or provide instant warnings when approaching predetermined financial thresholds.

The UK Gambling Commission has been instrumental in driving these innovations, mandating enhanced consumer protection measures that compel gambling platforms to prioritise player welfare. These regulatory requirements ensure that payment methods are not just transactional tools, but active participants in promoting responsible gambling. Advanced payment systems now offer comprehensive self-exclusion options, detailed transaction history, and integrated budgeting tools that help players maintain control over their gambling expenditure.

Pro tip: Configure automatic deposit limits and spend alerts on your gambling payment accounts to maintain strict financial discipline and prevent uncontrolled spending.

Key features that help UK players gamble safely via payment methods:

| Safety Feature | How It Helps | Typical Availability |

|---|---|---|

| Deposit Limits | Controls spending | Most UK platforms |

| Cooling-off Periods | Prevents impulsive bets | E-wallets, banking apps |

| Real-time Spend Tracking | Immediate oversight | Modern gambling interfaces |

| Self-exclusion Tools | Blocks account usage | Casino sites and e-wallets |

Risks, Mistakes, and Security Concerns

Gambling payment methods carry inherent risks that require careful navigation and understanding. Financial vulnerabilities in gambling transactions can expose players to significant monetary dangers if proper precautions are not implemented.

Common risks include potential identity theft, unexpected account charges, and uncontrolled spending patterns. Cybercriminals frequently target online gambling platforms, seeking to exploit weak security protocols or manipulate payment systems. Players must remain vigilant about protecting their financial information, using secure payment methods with robust encryption and two-factor authentication. Electronic wallets and prepaid cards offer additional layers of protection by separating gambling transactions from primary bank accounts, limiting potential financial exposure.

Moreover, psychological vulnerabilities can intersect with payment method risks. Certain payment technologies might inadvertently facilitate compulsive gambling behaviours by offering rapid, frictionless transactions. Instant deposit features, for instance, can lower psychological barriers to spending, potentially encouraging impulsive gambling decisions. Responsible players should seek payment methods that incorporate built-in friction mechanisms, such as mandatory cooling-off periods, transaction confirmations, and transparent spending tracking, which can help interrupt potentially harmful gambling patterns.

Pro tip: Use dedicated gambling payment accounts with pre-set spending limits and regularly monitor transaction histories to maintain financial control and detect any suspicious activity.

Take Control of Your Gambling Payments with Expert Guidance

Choosing the right gambling payment method is crucial for UK players aiming to balance security, speed, and responsible financial control. This article highlights common challenges such as safeguarding personal funds, avoiding impulsive spending, and understanding complex payment options like e-wallets or prepaid cards. If you feel overwhelmed by the variety of methods and want clear, trustworthy insights on UK licensed casinos that prioritise player safety and flexible payment systems, Geeky Gambler is your perfect companion.

Explore expertly reviewed UK casino sites with transparent payment options and robust security measures at Geeky Gambler. Our comprehensive guides and up-to-date industry news help you make informed decisions about welcome bonuses, withdrawal processes, and safer gambling tools. Don’t risk your money on platforms lacking proper safeguards — visit Geeky Gambler now to find casinos verified for licensing compliance and payment reliability. Start winning with confidence and control today.

Frequently Asked Questions

What are the most common payment methods used in online gambling?

Credit and debit cards like Visa and Mastercard are the most common payment methods, along with electronic wallets such as PayPal, Skrill, and Neteller. Prepaid cards and cryptocurrencies like Bitcoin are also gaining popularity among players.

How do payment methods impact the safety of my gambling transactions?

Payment methods can significantly impact the safety of transactions. Using secure methods with robust encryption, such as e-wallets and prepaid cards, can reduce the risk of identity theft and protect your financial information from cybercriminals.

What safety features should I look for in gambling payment methods?

Look for safety features such as deposit limits, cooling-off periods, real-time spending tracking, and self-exclusion tools. These features can help you manage your gambling expenditure and protect against overspending.

How can I ensure that my chosen payment method promotes responsible gambling?

To promote responsible gambling, choose payment methods that offer financial controls and self-management tools, such as setting deposit limits and allowing you to monitor your spending in real-time.